I have been running my business with this LLP since 2019, and since then I have never declared or declared any taxes. In 2022, I was informed that one of my friends had received a compound notice for his negligence in not paying taxes to the Inland Revenue Board of Malaysia (LHDN) for the business conducted through his LLP.

From 2019 to 2021, I was not exposed to this matter. As far as I know, we only need to prepare annual accounts and send them to the Companies Commission of Malaysia (SSM) every year with an annual fee of RM200.

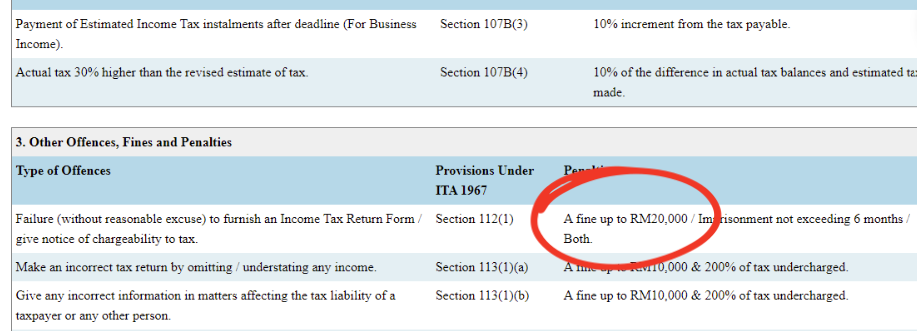

This confused me at first. I was informed that I did not need to make any tax declarations and only needed to focus on annual accounting and annual declaration. But it turned out that I had misunderstood, and for fear of being fined up to RM20,000, I quickly registered the income tax number for my LLP.

Before I start sharing how to register, it is good if we have a brief knowledge of LHDN tax matters for LLPs. For LLPs, it is taxed the same as Companies where the income taxed at the LLP level is at a tax rate of 24% in general.

However, LLPs with a capital contribution of RM2.5 million or less will enjoy a preferential tax rate of 19% on the first RM 500,000 of taxable income. Profits paid, credited or distributed to partners in the LLP are exempt from tax.

LLPs are not required to prepare financial statements audited by an auditor but must keep accounting and other records regularly and adequately to show the true financial position. For income tax purposes, LLPs are required to prepare complete accounting records containing profit and loss accounts, balance sheets and explanatory notes to the accounts.

However, if the accounting records are not prepared in the usual accounting format, the LLP shall keep the following records:

Registration of an LLP income tax number can be done online and entirely from home. You can also present yourself at the nearest LHDN office. They will help you use the same system on a computer provided for the registration process. However, at the LHDN office, you have to wait for a queue number to use the computer and it is quite uncomfortable to do it in a crowd. It is best that you do it at home or in your own office. I will briefly explain the steps of the LLP income tax number registration process as below:

It looks easy, but you have to fill it in carefully and there are some other important things that you need to do correctly. This writing is intended to give you an idea of the important processes before you can complete the registration of your LLP tax number whether at the LHDN office or if through your own personal computer.

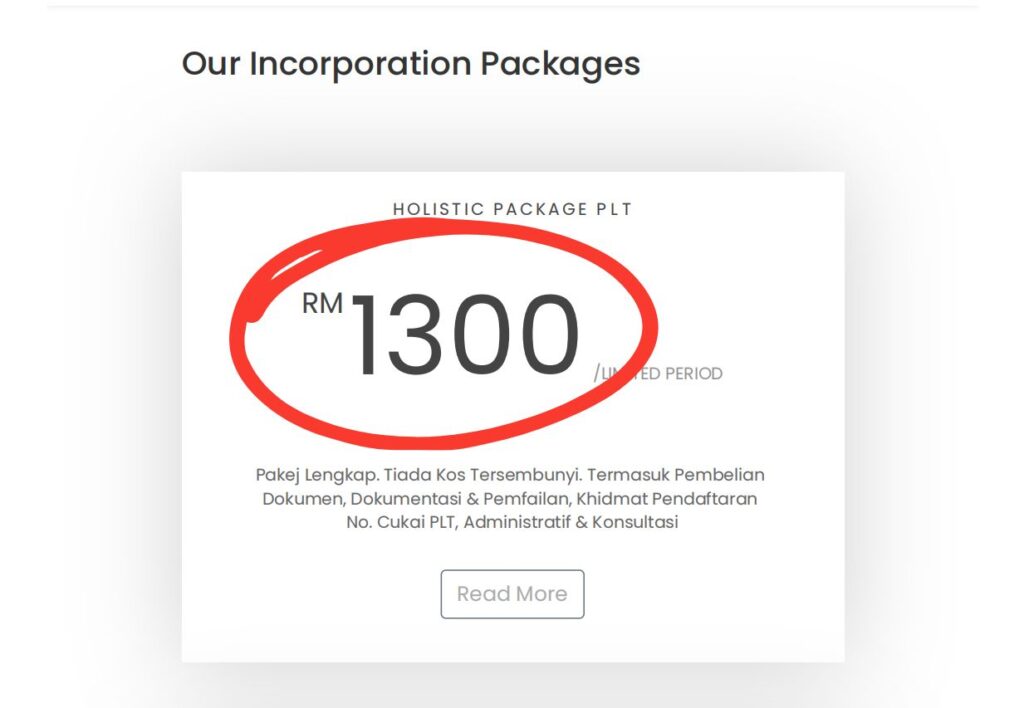

To carry out the process of registering an LLP tax number yourself, the cost is under RM100 (the cost of purchasing documents from SSM). So I was quite surprised when there were tax agents or secretarial companies that charged up to RM1,300 to do this process.

Regarding this matter, you have two options, either you can:

In this ebook, I have compiled and listed the important steps that you need to take so that you can do your own registration of your LLP income tax number. Here is what you will learn in the DIY “Do-it-Yourself” ebook LHDN LLP Guide and Steps Without Agent:

Four (4) advantages of this Ebook are as follows:

There are detailed step-by-step steps for each process and action to be taken.

Instead of wasting thousands of ringgit, you can do this process yourself. Be a smart user and business operator.

Believe it or not, I repeated all these processes almost 10 times because of small mistakes in documents and procedures. Don't make the same mistakes as me.

To get all the information, I made dozens of calls, here and there (SSM and LHDN). So, don't waste your energy like I did before.

I have gone back and forth from the office to LHDN to get information. I have wasted a lot of time. After reading this Ebook, everything is clear and I finally managed to register my LLP tax number.

Shahreza bin Shahrir

Kuala Lumpur

I have gone back and forth from the office to LHDN to get information. I have wasted a lot of time. After reading this Ebook, everything is clear and I finally managed to register my LLP tax number.

Han Ben Teh

Petaling Jaya, Selangor

I used the MudahPLT Ebook to open my LLP. I used this Ebook to register my LLP tax number. Easy with clear explanations.

Viknesvaran Selvarajan

Johor Bahru, Johor

#MudahPLT ialah sebuah platform penting yang membantu dan membimbing para usahawan di Malaysia yang ingin menceburi bidang perniagaan melalui struktur Perkongsian Liabiliti Terhad (PLT) sama ada secara kecil atau besar.

Seperti kata pepatah, sedikit-sedikit, lama-kelamaan menjadi bukit.

auroraprimaplt@gmail.com

Diuruskan oleh Aurora Prima PLT

© 2025 Dibina oleh Easyleads.my

_

This website uses cookies to provide you with the best browsing experience.