I restarted my business in 2019, after failing and having to close one of my LLPs in 2016. So, because of my own experience of opening a Limited Liability Partnership (LLP), I want to share how I prepared my Annual Accounts after receiving an email from the Companies Commission of Malaysia (SSM) in 2019.

The year 2020 was one of the years where I realised that failing to manage an LLP properly can affect the finances and stability of a business.

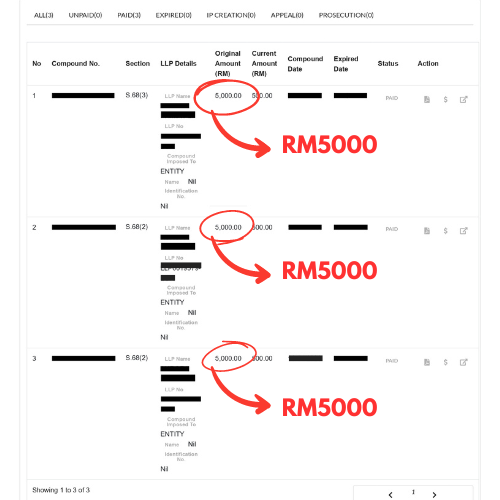

It is indeed not easy to manage a business entity. So, I took it easy and didn’t manage it properly. After three years of not carrying out any business activities and not submitting any financial reports, I received an official email (compound and penalty) from the Companies Commission of Malaysia (SSM). SSM sent a payment notice of RM15,000.

At that time, I didn’t have any knowledge about how to prepare financial reports and annual accounts, opening an LLP without any commercial activity. After receiving the notice, I panicked because I imagined RM15,000 that needed to be paid because of my negligence and lack of seriousness in business management matters.

This is my advice to you who are reading: Do not arbitrarily open a company or business entity if you have no clear plan or objectives. Just a reminder, you are not opening an “Enterprise (business license)”, but opening a Limited Liability Partnership (LLP) or a company (Private Limited / Limited). It involves commitment and is not a matter that we can take lightly.

Due to my negligence in the previous business, I entered a panic and anxious mode thinking about the RM15,000 payment that I had to pay if I failed to submit my LLP Annual Accounts for previous years.

I spent time and energy at first because I thought I didn’t want to spend money on preparing the document. But I was wrong, because the document I prepared did not meet what was requested by the SSM.

When we run a business, we need an organised system to track all changes, transactions, and expenses in the business. Accounting and bookkeeping have existed for a long time since humans started activities in trade and business.

With your LLP registered, you have ongoing obligations of the LLP including registration of changes, keeping records of accounts, annual declarations to SSM and other statutory compliance matters.

Keeping Accounting Records

Accounting Record Keeping Documents

As a legitimate business entity, here are the documents that you need to prepare for the purpose of your LLP’s annual accounting:

Period of LLP Annual Declaration

As an LLP, you must ensure that reports are made to SSM annually within ninety (90) days from the end of the LLP’s financial year. Here are the important things that you need to do in this process:

Extension of Submission of Annual Declaration to SSM

If you are unable to prepare your LLP Annual Declaration within the stipulated time, an application for an extension period needs to be made after the end of the financial year and at least thirty (30) days after the date of submission of the annual declaration with a fee payment. Reasons that may be considered by the Registrar for granting an extension are as follows:

Reading all that has been shared above may have started to make you dizzy. Actually, I was like you originally because I did not take into account the importance of accounting in my business activities before. To do your LLP accounting, agencies or secretarial companies charge up to RM1,500 to RM2,000 to do this process.

You have two options, either you can:

In this ebook, I have documented and listed the important steps that you need to take so that you can do your own accounting and annual declaration of your LLP. Here is what you will get in the DIY ebook “Do-it-Yourself Guide and Steps to Annual Accounting of LLP Without Agent”:

The four (4) advantages of this ebook are as follows:

There are detailed step-by-step instructions for each process and action to be taken

Instead of wasting thousands of ringgit, you can do this process yourself. Be a smart business user and entrepreneur.

Believe it or not, I almost took two months to get all the information. Don't make the same mistake as me

To get all the information, I made dozens of calls, here and there (SSM and LHDN). So, don't waste your energy like I did before

I used to be confused about how to make an LLP account. I was also not sure how to send information to SSM. Alhamdulillah, now I can do it myself and don’t have to spend thousands of ringgit anymore.

Huzaifah bin Jazlan

Kuantan, Pahang

Straight Forward! I just need to follow this step-by-step ebook. Now I am more confident with my business.

Jenice Poh

Georgetown, Pulau Pinang

Just follow the steps provided. I can already do my LLP account on my own. No need to look for an agent anymore.

Vicknesh Kumar

Kajang, Selangor

#MudahPLT ialah sebuah platform penting yang membantu dan membimbing para usahawan di Malaysia yang ingin menceburi bidang perniagaan melalui struktur Perkongsian Liabiliti Terhad (PLT) sama ada secara kecil atau besar.

Seperti kata pepatah, sedikit-sedikit, lama-kelamaan menjadi bukit.

auroraprimaplt@gmail.com

Diuruskan oleh Aurora Prima PLT

© 2025 Dibina oleh Easyleads.my

_

This website uses cookies to provide you with the best browsing experience.